- Inflation rose more than expected in April, spooking investors.

- Bank of America’s Savita Subramanian says active managers are ill-prepared for it.

- She shared two trades for an inflationary environment.

Investors are getting a strong dose of inflation fears this week, as the consumer price index (CPI) – a key measure of inflation – jumped more than expected in April.

Prices rose by 4.2% from last April, and by 0.8% from March, both higher than economists were anticipating.

Stocks were down big because of the surprise. The Dow had its biggest daily drop since January, while the S&P 500 fell by as much as 3.4% and the tech-heavy Nasdaq was down by more than 4%.

In a May 9 note to clients, Savita Subramanian, Bank of America’s head of US equity and quantitative strategy, warned that investors still haven’t priced the threat into certain factors and areas of the stock market.

"Inflation-sensitive sectors such as Energy and Materials are still trading at big discounts to history across a variety of metrics we track, and the S&P 500 overall is discounting a tepid inflation outlook," Subramanian said in the note.

There's no telling how high inflation rates could climb. Cash-loaded consumers are pouring money into the economy as COVID-19 cases fall amid rising vaccinations rates. And, the demand spike is squeezing supply chains.

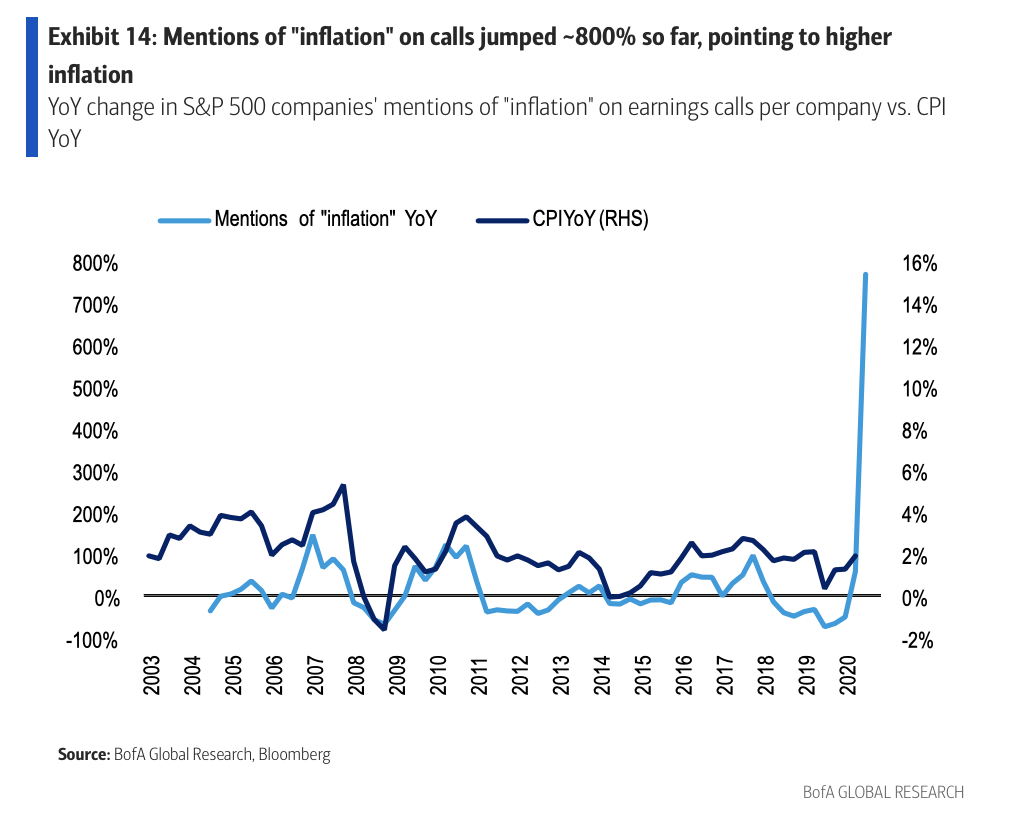

Corporate America is also highly concerned about what inflation will do to margins as firms incur higher costs for goods and pay higher wages to workers. The below chart shows the spike in mentions of inflation in earnings calls.

The Federal Reserve has said they plan to ignore the surge in inflation, which they expect to be temporary. But how long the surge will last and how high it will climb remains to be seen, and the central bank could raise interest rates earlier than investors are expecting.

This is one reason that investors fear inflation. If the Fed is forced to raise interest rates and tighten its monetary policy to squash ballooning prices, it takes liquidity out of the system (creating an environment that's less friendly to traders) and causes bond yields to rise (making them a more attractive asset relative to stocks). Even if the Fed doesn't hike rates, bond yields would still likely rise along with inflation, though the Fed could still choose to pin them down through quantitative easing.

Ten-year Treasury yields rose seven basis points on Wednesday to 1.69% as stocks fell.

Another reason why inflation is a concern is that corporate earnings numbers become less impressive, as do dividend payments.

2 trades to position for inflation

Subramanian maintained a recommendation her team had made in March: the two best trades for an inflationary environment are to lean into value stocks over growth, and small-caps over large-caps.

Investors can gain exposure to these areas of the market through funds like the iShares S&P 500 Value ETF (IVE) and the Vanguard Small-Cap ETF (VB).

"Strong profits, higher inflation and rising corporate sentiment all point to a continued rotation into Value, which active managers are still underweight," Subramanian said in the May 9 note. "Investors are also not positioned for an upcoming inflation cycle, being underweight pro-inflation stocks relative to anti-inflation stocks."

In the March note from Subramanian and her colleagues Jill Carey Hall and Ohsung Kwon, the team wrote: "Our US Regime Indicator has shifted to Mid-Cycle, a phase where inflation is typically strongest. In this phase, small caps and Value have typically outperformed large caps and Growth - further supported by the profits recovery and economic rebound we expect this year. Small caps and Value stocks were also some of the best-performing assets during the inflationary period of the late 60s."

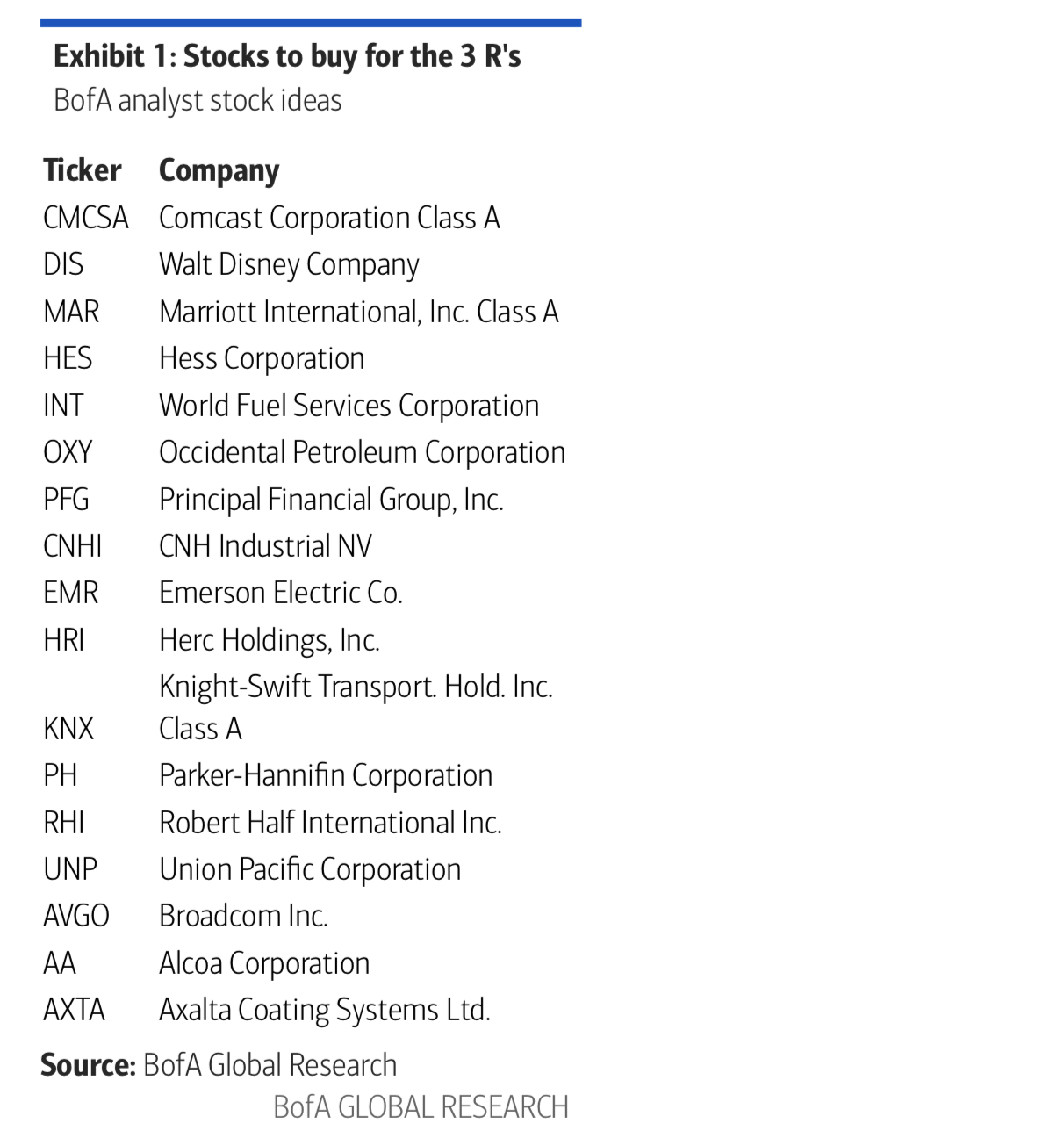

They also included a list of 17 buy-rated stock picks for an inflationary environment, which are shown below and detailed more here.